Mortgage Rates: What You Should Know

Mortgage rates are a crucial factor for anyone buying a home or refinancing a mortgage. They determine how much interest you’ll pay over time and can significantly impact your monthly payments. Understanding how mortgage rates work, what influences them, and how to get the best deal is essential for homebuyers and homeowners alike. In this article, we’ll explore everything you need to know about these rates and how they can affect your financial decisions.

What Are Mortgage Rates?

Simply put, rates are the interest charged on a home loan. These rates dictate how much you’ll end up paying in interest throughout the loan’s duration. A lower mortgage rate means lower monthly payments and less interest paid over time, while a higher rate leads to increased costs.

Factors That Affect Mortgage Rates

Several factors influence mortgage rates, with one of the most significant being the overall economy. When the Federal Reserve raises or lowers its interest rates, rates often move in the same direction. So, if the Fed hikes rates to curb inflation, expect rates to increase. Conversely, if the Fed lowers rates, rates tend to drop.

Another key factor is the bond market. Lenders tie rates to yields on mortgage-backed securities. When bond yields rise, rates generally follow. When bond yields fall, rates usually decline.

Types of Mortgage Rates

There are two main types of mortgage rates: fixed-rate and adjustable-rate. Fixed-rate mortgages lock in a consistent interest rate for the life of the loan, providing stability and predictability in your payments. On the other hand, adjustable-rate mortgages (ARMs) have interest rates that can fluctuate based on market conditions. While ARMs often start with lower rates than fixed loans, they carry the risk of rising payments over time as rates adjust.

How Mortgage Rates Affect Home Buying

Mortgage rates have a significant impact on homebuyers. When rates are low, you can afford a larger loan, which might enable you to buy a more expensive home. Low mortgage rates also mean lower monthly payments, freeing up more of your budget. However, when these rates rise, it can make borrowing more expensive, limiting your buying power and potentially cooling the housing market.

Tips for Finding the Best Rates

To secure the best rates, it’s important to shop around. Compare rates from different lenders, and use online calculators to estimate how each rate will affect your monthly payments. Don’t just rely on one lender – getting multiple quotes can help you find a better deal. You might also want to work with a mortgage broker who can search for the most competitive rates on your behalf.

Your credit score plays a big role in determining what kind of rates you qualify for. Lenders typically offer better rates to borrowers with higher credit scores. By improving your credit score—through paying off debts and maintaining a strong credit history—you can increase your chances of locking in a low rate.

The Role of Mortgage Points

Mortgage points, also known as discount points, can help reduce your mortgage rate. By paying for points upfront, you can lower your rate and, in turn, your monthly payments. Each point typically costs 1% of the loan amount and can reduce your rate by about 0.25%. However, this strategy only makes sense if you plan to stay in your home for a long period since the upfront cost takes time to recoup through lower payments.

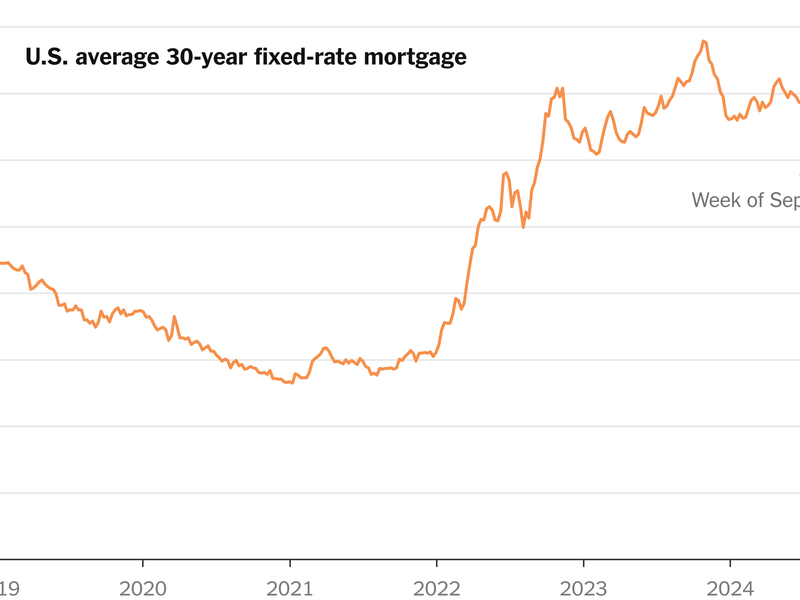

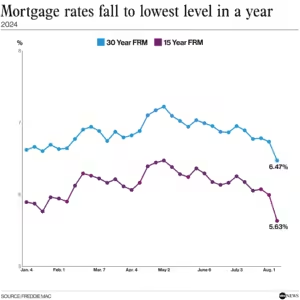

Current Trends in Mortgage Rates

Mortgage rates fluctuate based on economic conditions, market trends, and Federal Reserve actions. In recent years, rates have been at historic lows, particularly during the COVID-19 pandemic. This allowed many homebuyers and homeowners to secure favourable rates. However, as the economy recovers and inflation rises, experts anticipate that rates may increase in the coming years.

Keeping an eye on these trends is essential if you’re planning to buy or refinance a home. Economic indicators like inflation, job growth, and the Fed’s interest rate policies can give you a sense of where rates are heading.

Refinancing and Mortgage Rates

Refinancing your mortgage can help you take advantage of lower rates. If you locked in a higher rate in the past, refinancing to a lower rate can reduce your monthly payments and save you money over the life of the loan. However, refinancing isn’t free. You’ll need to account for closing costs and fees, which could eat into your savings, especially if you don’t plan to stay in your home for much longer.

The Impact of Inflation

Inflation plays a significant role in influencing these rates. When inflation is high, the Federal Reserve may increase interest rates to slow it down, which can lead to higher mortgage rates. Conversely, when inflation is under control, these rates tend to stay low. For homebuyers, understanding this dynamic can help you make more informed decisions about when to lock in your mortgage.

Planning for Future Mortgage Rate Changes

It’s essential to keep an eye on future changes in rates, especially if you’re considering a home purchase or refinance. Economic data, the Federal Reserve’s policies, and inflation trends will all play a part in determining how rates move. Keeping up to date with these factors can help you make the right financial decisions when it comes to your mortgage.

Conclusion:

Understanding mortgage rates is critical for anyone looking to buy a home or refinance their mortgage. By knowing how rates are determined, shopping around for the best deals, and keeping an eye on economic trends, you can make better decisions about your mortgage. Whether you’re aiming for a low fixed-rate mortgage or considering an adjustable-rate loan, being informed about mortgage rates will help you navigate the housing market with confidence.